Note that the present annuity calculator can deal exclusively with fixed immediate annuities. There are multiple types, including those that pay out at a standard rate in the future, along with those whose values might be affected by general changes in the market. They are often used to supplement 401(ks), IRAs, and other retirement savings vehicles.

Great! The Financial Professional Will Get Back To You Soon.

When t approaches infinity, t → ∞, the number of payments approach infinity and we have a perpetual annuity with an upper limit for the present value. You can demonstrate this with the calculator by increasing t until you are convinced a limit of PV is essentially reached. Then enter P for t to see the calculation result of the actual perpetuity formulas.

Calculate Present Value of Future Cash Flows

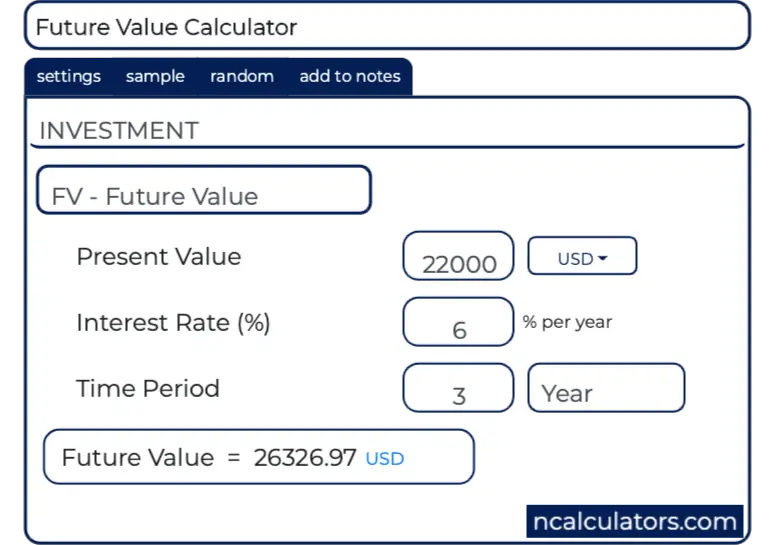

For a present value of $1000 to be paid one year from the initial investment, at an interest rate of five percent, the initial investment would need to be $952.38. The present value of an annuity is determined by using the following variables in the calculation. Studying this formula can help you understand how the present value of annuity works. For example, you’ll find that the higher the interest rate, the lower the present value because the greater the discounting. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Continuous Compounding (m ⇒ ∞)

Different annuities serve different purposes, and have pros and cons depending on an individual’s situation. Most people use annuities as supplemental investments in combination with other investments such as IRAs, 401(k)s, or other pension plans. Many people find that as they get older, investment options with tax shields approach or reach their contribution limits. As a result, conservative investment options can be sparse, and buying an annuity can be a viable alternative. Annuities can also be helpful for those seeking to diversify their retirement portfolios.

Recommended Finance Resources

In our illustrative example, we’ll calculate an annuity’s present value (PV) under two different scenarios. By submitting this form, you consent to receive email from Wall Street Prep and agree to our terms of use and privacy policy. For this reason, we created the calculator for instructional purposes only. Still, if you experience a relevant drawback or encounter any inaccuracy, we are always pleased to receive useful feedback and advice. See this link for detailed explanation of present value of annuity concepts. Laura started her career in Finance a decade ago and provides strategic financial management consulting.

After all, these retirement savings accounts do have the primary purpose of providing income in retirement. Annuities can help dictate how retirees live in accordance with their funds or at least make their future income streams more predictable through fixed annuities. As a result, annuities can act as a sort of insurance for guaranteed income in retirement. The resulting annuities are classified as “qualified annuities,” which means they are funded with pretax money. An immediate annuity involves an upfront premium that is paid out from the principal fairly early, anywhere from as early as the next month to no later than a year after the initial premium is received. This means that, for the most part, immediate annuities will not have accumulation phases.

Note that the Help and Tools panel will be hidden when the calculator is too wide to fit both on the screen. Moving the slider to the left will bring the instructions and tools panel back into view. Clicking the “Reset” button will restore the calculator to its default settings. I promise not to share your email address with anyone, and will only use it to send the monthly update. This field should already be filled in if you are using a newer web browser with javascript turned on. If it’s not filled in, please enter the web address of the calculator as displayed in the location field at the top of the browser window (-online-calculator-use.com/____.html).

The difference affects value because annuities due have a longer amount of time to earn interest. The future value of an annuity refers to how much money you’ll get in the future based on the rate of return, or discount rate. Conversely, if you wanted to take out a $279,161.54 mortgage for a home on a 6%, 20-year monthly repayment term, present value calculations with tell you lessee legal definition of lessee that your monthly payments will be $2,000.00. You probably noticed that our NPV calculator determines two values as results. You should consider the annuity calculator as a model for financial approximation. All payment figures, balances, and interest figures are estimates based on the data you provided in the specifications that are, despite our best effort, not exhaustive.

- In many cases, this sum is paid annually over the duration of the investor’s life.

- Because the funds are invested in assets that fluctuate in value, it is possible for the total value of assets in a variable annuity to be lower than the principal.

- An annuity’s future value is also affected by the concept of “time value of money.” Due to inflation, the $500 you expect to receive in 10 years will have less buying power than that same $500 would have today.

- Because there are two types of annuities (ordinary annuity and annuity due), there are two ways to calculate present value.

- While you would receive a total of $10,000, the present value is $7,721.73 because it is discounted each year using the 5% interest rate.

- The present value of an annuity is the total value of all of future annuity payments.

For example, suppose that a bank lends you $60,000 today, which is to be repaid in equal monthly installments over 30 years. A lower discount rate results in a higher present value, while a higher discount rate results in a lower present value. Since this calculator has been tested to work with many setup and entry combinations, I probably won’t be able to find and fix the problem without knowing your set-up and the data you entered into the calculator. Note that my expertise is in creating online calculators, not necessarily in all of the subject areas they cover. While I do research each calculator’s subject prior to creating and upgrading them, because I don’t work in those fields on a regular basis, I eventually forget what I learned during my research. So if you have a question about the calculator’s subject, please seek out the help of someone who is an expert in the subject.

An individual cash flow or annuity can be determined by discounting each cash flow back at a given rate using various financial tools, including tables and calculators. The “present value” term refers to an individual cash flow at one point in time, while the term “annuity” is used more generally to refer to a series of cash flows. The present value of annuity table contains the factors used to determine an individual cash flow at one point in time. This can be done by discounting each cash flow back at a given rate by using various financial tools, including tables and calculators. On the other hand, an “ordinary annuity” is more so for long-term retirement planning, as a fixed (or variable) payment is received at the end of each month (e.g. an annuity contract with an insurance company).

For more information about or to do calculations involving retirement, IRAs, or 401(k)s, please visit the Retirement Calculator, Roth IRA Calculator, IRA Calculator, or 401K Calculator. In general, types of annuities are classified according to the following features. These are generally considered to be the most common type of annuities, though the other variations are also available. As a starting point, let’s have a brief overview of the specific terms you can find in our calculator. Discover the scientific investment process Todd developed during his hedge fund days that he still uses to manage his own money today. It’s all simplified for you in this turn-key system that takes just 30 minutes per month.